Maximizing Profit in Forex Trading Strategies and Insights 1594120313

Maximizing Profit in Forex Trading: Strategies and Insights

Forex trading is one of the most dynamic and compelling markets in the world, characterized by its high liquidity and volatility. With the potential for large profits, many traders are drawn to the allure of trading currencies. However, achieving consistent success in this realm requires more than just a basic understanding of how Forex works. To truly maximize your profit, you need a comprehensive strategy that considers both technical aspects and personal trading psychology. In this article, we will dive deep into essential strategies for Forex trading profit, including risk management, analytical techniques, and the role of trading platforms like forex trading profit Trading Platform QA.

Understanding the Forex Market

The Forex market is the largest and most liquid financial market in the world, open 24 hours a day, five days a week. This constant accessibility allows traders to enter and exit positions at any time, which can be advantageous. However, the market’s volatility can also lead to significant losses if not properly managed. Understanding the factors that influence currency prices—such as political stability, economic indicators, and market sentiment—is crucial for successful trading.

Key Strategies for Maximizing Profit

1. Risk Management

Risk management is a cornerstone of successful Forex trading. It involves identifying, assessing, and mitigating risks associated with trading activities. One fundamental approach to risk management is the use of stop-loss orders, which allow traders to limit their losses on a particular trade. By setting a predetermined exit point, traders can protect their capital from unexpected market movements.

Another effective risk management strategy is position sizing. This involves determining how much capital to allocate to each trade based on your overall trading account size and risk tolerance. As a rule of thumb, traders should never risk more than 1-2% of their capital on a single trade. This disciplined approach can help ensure long-term success and stability in your trading business.

2. Technical Analysis

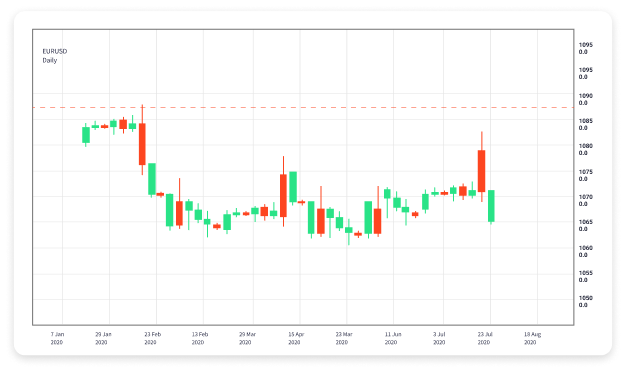

Technical analysis is a method that traders use to evaluate currency pairs based on historical price movement and market trends. This involves analyzing charts, indicators, and patterns to predict future price movements. Some of the most common tools used in technical analysis include moving averages, RSI (Relative Strength Index), and Fibonacci retracements.

By studying historical data and understanding price behavior, traders can spot potential entry and exit points, enhancing their chances of making profitable trades. It’s essential to combine multiple indicators for more reliable signals, as relying on a single tool can lead to false conclusions.

3. Fundamental Analysis

While technical analysis focuses on price patterns, fundamental analysis looks at the economic factors that influence currency values. This includes analyzing economic indicators such as GDP growth, employment rates, inflation, and central bank decisions. Understanding these factors can provide traders with insights into the long-term direction of a currency pair.

For effective trading, it’s crucial to keep abreast of significant news releases and economic events. A single piece of economic news can lead to sharp spikes in currency values, affecting even the most meticulously planned trades. Incorporating fundamental analysis into your trading strategy can add a layer of depth and context that purely technical analysis might miss.

4. Trading Psychology

The psychological aspect of trading is often overlooked but is just as important as technical and fundamental analysis. Successful traders possess a strong mindset that allows them to make rational decisions even in the face of uncertainty and volatility. Emotions such as fear and greed can cloud judgment, leading to impulsive actions that erode profits.

One way to cultivate a disciplined trading mindset is to develop a trading plan. This document should outline your trading goals, risk tolerance, entry and exit strategies, and methods of analysis. By adhering to a plan, traders can minimize emotional decision-making and maintain consistency in their approach.

Leveraging Technology for Trading Success

In today’s digital world, technology plays a significant role in Forex trading. Various tools and platforms are available to assist traders in executing their strategies efficiently. For instance, automated trading systems and expert advisors can execute trades on your behalf based on pre-defined criteria, helping maintain discipline and reduce emotional trading.

Moreover, utilizing trading platforms that provide real-time data, advanced charting tools, and comprehensive analytical resources can significantly enhance a trader’s ability to make informed decisions. Platforms like Trading Platform QA offer robust solutions that cater to both novice and experienced traders, facilitating a smoother trading experience.

Continuous Learning and Adaptation

The Forex market is constantly evolving, influenced by global economic conditions and geopolitical events. As such, traders must engage in continuous learning and adaptation to stay ahead of the curve. This involves not only refining your trading strategies but also keeping up to date with market trends, news, and emerging trading technologies.

Participating in trading communities, attending webinars, and reading books on trading psychology and strategy can provide valuable insights and knowledge. The more informed and educated you are, the better equipped you’ll be to make decisions that lead to profitable trading.

Conclusion

Maximizing profit in Forex trading is a multifaceted endeavor that requires a blend of technical skills, fundamental understanding, psychology, and risk management. By developing a solid trading plan, leveraging analytical tools, and continuously educating yourself, you can increase your chances of success in this exciting market. Remember, the journey to Forex trading profitability is a marathon, not a sprint, and consistent effort and discipline will pave the way for long-term gains.