Mastering Forex Trading Strategies for Success 1924665954

Forex trading can be a highly lucrative yet complex venture. To navigate the unpredictable currents of the foreign exchange market, traders must equip themselves with effective forex trading strategies Trading Cambodia. This article will delve into various strategies that can help traders avoid common pitfalls and increase their chances of success. Whether you are a novice or an experienced trader, understanding these strategies is essential. Let’s explore the different types of Forex trading strategies that can help you thrive.

Understanding Forex Trading

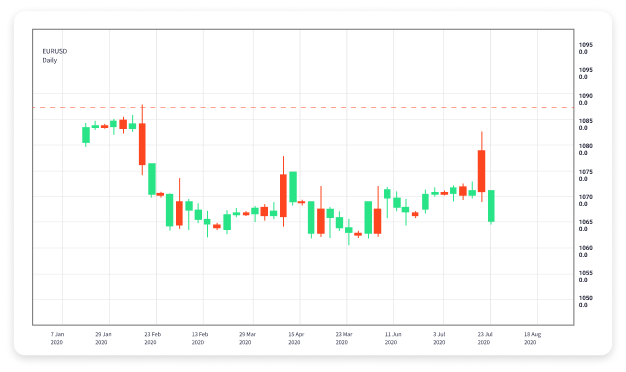

Forex trading involves buying and selling currency pairs on the foreign exchange market to profit from fluctuations in exchange rates. Unlike stock trading, where shares of a company are bought and sold, forex trading focuses entirely on currency pairs, such as EUR/USD, GBP/USD, and USD/JPY. To trade effectively, one must comprehend how various factors influence currency values, including economic indicators, interest rates, and geopolitical events.

Key Forex Trading Strategies

1. Scalping

Scalping is a short-term trading strategy that involves making numerous small trades throughout the day. Traders seek to capture minor price changes, usually profiting from small price movements. Scalping requires a strong understanding of market conditions and quick decision-making skills. Traders who use this strategy typically rely on technical analysis and use high leverage to maximize profits.

2. Day Trading

Similar to scalping, day trading consists of opening and closing trades within the same day. However, day traders maintain positions longer, typically holding them for several minutes to hours. This strategy capitalizes on small price movements and aims to profit from volatility during the trading session. Day traders often use a combination of technical indicators, news analysis, and economic reports to make informed trading decisions.

3. Swing Trading

Swing trading is a medium-term strategy that involves holding positions for several days to weeks. Traders using this strategy focus on capturing profit from price swings in the market. Swing traders often rely on both technical analysis and fundamental analysis to identify potential reversals and market trends. This method is suitable for those who cannot monitor the market continuously and prefer a more relaxed approach to trading.

4. Position Trading

Position trading is a long-term strategy that involves holding onto trades for weeks, months, or even years. Traders who employ this strategy focus on long-term trends and economic fundamentals rather than short-term price movements. Position traders conduct thorough research and analysis to determine the overall direction of a currency pair and take a position based on their long-term outlook.

Combining Strategies for Success

Many successful traders combine multiple strategies based on their trading style, risk tolerance, and market conditions. For instance, a trader may use scalping during volatile market sessions while practicing swing trading during more subdued periods. By diversifying their approach, traders can mitigate risks and take advantage of various market opportunities.

Risk Management in Forex Trading

Regardless of the trading strategy employed, effective risk management is vital in forex trading. This includes setting stop-loss levels to limit potential losses, determining position sizes based on account balance, and never risking more than a set percentage of total capital on a single trade. Proper risk management ensures that no single trade can significantly impact a trader’s overall account balance.

Tools and Resources for Forex Traders

To successfully implement trading strategies, traders must utilize a variety of tools and resources. Some essential tools include:

- Trading Platforms: Reliable trading platforms provide access to real-time charts, price quotes, and trading tools necessary for executing trades.

- Technical Indicators: Tools like moving averages, Relative Strength Index (RSI), and Bollinger Bands help traders analyze price movements and market conditions.

- News Feeds: Awareness of economic news and events is crucial as they can impact currency movements significantly. Traders should stay updated with economic calendars and news releases.

- Forex Forums and Social Trading: Engaging with other traders can provide insights, tips, and strategies that may enhance a trader’s approach to the market.

Emotional Discipline in Trading

One of the most significant challenges in forex trading is managing emotions. Fear and greed can lead to impulsive decisions that result in losses. It is essential for traders to develop emotional discipline and stick to their trading plans, regardless of market conditions. Developing a routine, keeping a trading journal, and setting clear goals can help maintain focus and prevent emotional decision-making. Remember, effective trading is a marathon, not a sprint.

Conclusion

Forex trading strategies vary widely, and what works for one trader may not work for another. It is essential to experiment with different strategies, find the ones that fit your trading style, and remain disciplined in your approach. The market is inherently unpredictable, but with the right strategies and mindset, traders can navigate its complexities and work toward achieving their financial goals.