Mastering Advanced Forex Trading Techniques 1759361110

Forex trading is not just about buying and selling currencies; it is an intricate endeavor that requires knowledge, skill, and a robust strategy. Successful traders often turn to advanced forex trading Trading FX Broker for resources and platforms to enhance their trading capabilities. As you delve deeper into the world of forex, understanding advanced trading techniques can set you apart from the masses. This article explores some advanced methods and strategies that can help you become a proficient forex trader.

Understanding Technical Analysis

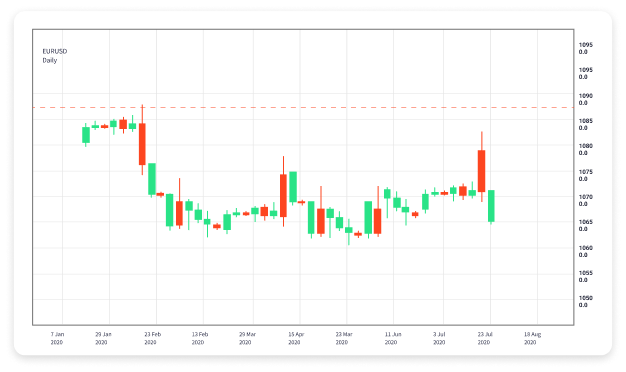

Technical analysis is a cornerstone of advanced forex trading. It involves analyzing historical price movement to forecast future price trends. Traders employ various tools, such as chart patterns, indicators, and candlestick formations, to make informed decisions.

One of the most effective tools in technical analysis is the use of Fibonacci retracement levels. This technique identifies potential reversal points in the market by analyzing the ratios derived from the Fibonacci sequence. Other crucial indicators include Moving Averages, Relative Strength Index (RSI), and Bollinger Bands, which traders can use to gauge market conditions.

Advanced Charting Techniques

Utilizing advanced charting techniques can significantly impact your trading outcomes. For example, understanding the nuances of different chart types—such as line charts, bar charts, and candlestick charts—can give you unique insights. Candlestick patterns, in particular, are invaluable, as they not only show price movements but also offer insights into market sentiment.

Moreover, combining multiple time frame analysis can provide a more holistic view of the market. By analyzing patterns across different time frames, traders can identify both short-term and long-term trends, allowing for more strategic decision-making.

Leverage and Risk Management

One of the most critical aspects of advanced forex trading is understanding leverage and risk management. Leverage allows traders to control larger positions with a smaller amount of capital. While it can amplify profits, it also magnifies losses. Therefore, managing leverage effectively is essential. Advanced traders often employ techniques such as the Kelly Criterion to determine optimal bet size relative to their bankroll.

Implementing stringent risk management strategies, including setting stop-loss orders and employing the 1% rule—where you risk only one percent of your trading capital on any given trade—can help safeguard your investments.

Algorithmic and Automated Trading

In the digital age, algorithmic and automated trading systems have become increasingly popular among advanced traders. These systems utilize algorithms to make trades based on predefined criteria, allowing for speed and efficiency that manual trading cannot match. However, developing a successful algorithm requires a deep understanding of market trends and trading strategies.

Backtesting these algorithms against historical data is crucial to evaluate their performance and refine the trading strategy. Many traders also use platforms that offer automated trading services, enabling them to implement complex strategies without the need for continuous monitoring.

Fundamental Analysis and Market Sentiment

While technical analysis focuses on price movements, fundamental analysis delves into economic indicators and news events that influence currency values. Advanced traders must be adept at interpreting data such as GDP, unemployment rates, inflation, and central bank policies. These elements can heavily impact market sentiment and, subsequently, currency valuation.

Understanding the interplay between economic indicators and market sentiment can provide traders with a competitive edge. Utilizing a calendar of economic events and following news related to geopolitical situations can also help traders anticipate market volatility and adjust their strategies accordingly.

Psychological Aspects of Trading

Perhaps one of the most overlooked areas in forex trading is the psychological aspect. Advanced traders recognize that emotions can significantly impact trading performance. Fear and greed can lead to impulsive decisions, resulting in losses. Establishing a solid trading plan and sticking to it is paramount.

Practicing mindfulness and maintaining discipline in executing trades can mitigate emotional influences. This might involve setting clear trading goals, journaling trades, and regularly reviewing strategies to ensure an objective approach to trading.

Continuous Learning and Adaptation

The forex market is dynamic and ever-changing; hence, continuous learning is vital for success. Advanced traders stay updated with the latest trading strategies, market trends, and regulatory changes. Engaging with trading communities, attending webinars, and enrolling in courses can provide valuable insights and foster growth as a trader.

Additionally, adapting your strategy based on market conditions is crucial. What works in one market environment may not work in another; traders must be flexible in their approaches and ready to pivot when necessary.

Conclusion

Mastering advanced forex trading is a multifaceted journey that combines technical skills, psychological resilience, and a commitment to continuous improvement. By implementing the strategies discussed in this article—such as technical analysis, risk management, algorithmic trading, and fundamental analysis—traders can enhance their trading performance and navigate the complexities of the forex market more effectively.

Ultimately, it is the blend of knowledge, strategy, and discipline that will empower traders to succeed in the dynamic world of forex trading.